Join the Community!

Explore Our Blog

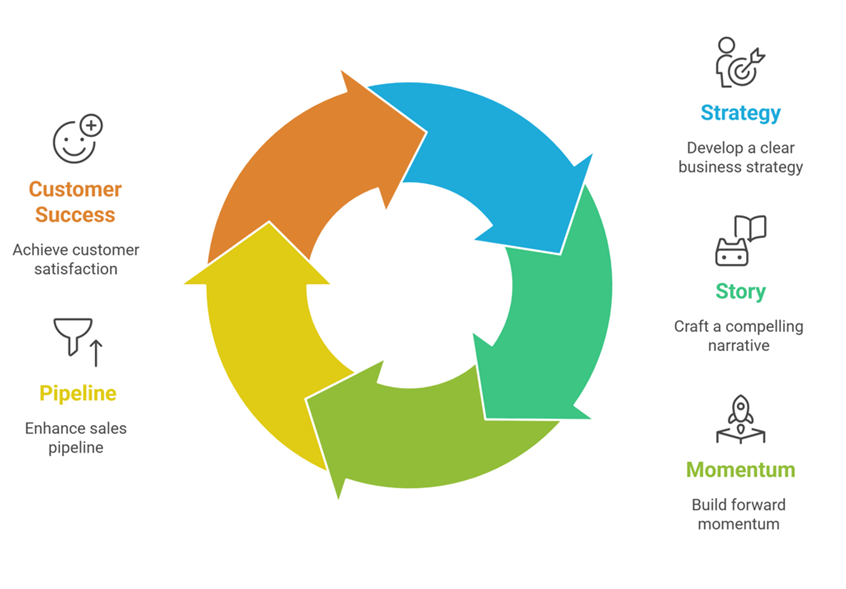

Planning your 2026 channel strategy is not about filling a calendar or refreshing a few campaigns. It is about preparing for a year where partner behaviors, budgets, technology, incentives, and buyer expectations will shift again. Much of the input you need will arrive late, change mid-quarter, or conflict with what you planned last year. The Challenge is Real: You Are Planning With Incomplete Information Partners do not yet know their 2026 priorities. Buyers are changing direction quarter by quarter. Vendors are adjusting incentives. The economic climate is unpredictable. Even internal teams are revisiting roles, tech stacks, and investment levels. The good news is that you do not need perfect clarity to create a strong 2026 plan. You only need a thoughtful structure that focuses on what you know today, identifies the gaps, and leaves enough flexibility to adjust when new guidance arrives. A solid strategy ties together partner lifecycle activities, to-through-with motions, events, MDF, travel, content, and the systems that support partner engagement. Start With What You Already Know Even when the larger landscape is unclear, you enter planning with reliable signals. These include partner-sourced and influenced revenue patterns, product priorities, partner mix, early event commitments, travel expectations, and guidance from 2025 performance. These signals give you a foundation strong enough to begin shaping your strategy without waiting for every line item to be final. Use Your 2025 Data as Your Guide Your 2026 plan becomes stronger and more accurate when you base it on what actually happened in 2025. Data removes guesswork, reveals partner behavior patterns, highlights friction points, and shows you which motions work at each stage of the partner lifecycle. This includes performance, activity, and campaign data, as well as the direct feedback partners give you throughout the year. CRM insights help you understand the true contribution of your partners. Look at sourced revenue, influenced pipeline, win rates, deal cycle length, partner type performance, and which partners consistently engage in opportunities. These signals show where your recruitment, onboarding, enablement, and co-selling motions need more focus. Campaign reporting shows which messages landed, which assets partners used in opportunities, and which plays had real activation. This helps you refine content themes, simplify materials, and eliminate the programs that looked good on the calendar but had little impact. Lean on 2025 performance patterns to shape your 2026 sell-to and sell-through motions. Partner portal activity is a clear indicator of partner intent and engagement. Training paths, content downloads, deal registrations, resource usage, and login patterns show you who is leaning in, who is drifting, and which middle-tier partners are ready for more support. This data helps you strengthen onboarding, activation, and growth stages. Partner feedback provides context that your systems cannot. Partners will tell you where onboarding felt heavy, which assets were confusing, which incentives did not motivate them, and where they needed more support in deals. They also highlight gaps in portal usability, event value, communication frequency, and the competitive pressures they face in the field. Their feedback provides the “why” behind your CRM and portal trends and should directly influence your 2026 content priorities, lifecycle adjustments, program updates, and regional plans. When you combine performance data with activity data and partner feedback, you get a clear and complete view of what to change, what to continue, and where partners need deeper support in 2026. This integrated view is essential when planning with incomplete information, because it gives you enough real insight to move forward confidently even before every detail of the year is set. Align Market and Sell To, Through, and With Directly to the Partner Lifecycle A strong strategy connects your lifecycle work to how partners move from awareness to growth. Market and sell to partners during recruitment, onboarding, and early enablement. This stage includes your partner value proposition, early messaging, program benefits, onboarding content, portal experience, incentives, and the “what’s in it for them” clarity partners need at the start. Your focus here is education, differentiation, and removing friction so partners understand your offer and where they fit in your ecosystem. Market and sell with partners during engagement and growth. This stage is where joint GTM motions come to life. Co-marketing events, workshops, joint selling, executive alignment, and late-stage deal support all fall under this. This motion helps partners deepen commitment, improve competitive positioning, and accelerate opportunities already in motion. “With” is where momentum becomes revenue. Market and sell through partners during activation and advocacy. This includes the assets and plays partners bring to market on your behalf. Co-branded campaigns, sales kits, social content, MDF activities, partner-led events, and referral or advocacy plays all support this stage. The emphasis is on simple, repeatable motions proven by your 2025 insight, so partners can confidently represent your solutions to their customers. When your lifecycle aligns with how you market and sell to, through, and with partners, your strategy becomes focused, predictable, and built for momentum. Involve Channel Sales in a Targeted, Efficient Way Channel sales teams hold information that shapes better planning. Their insight helps you clarify partner performance, understand competitive motion, and identify the partners who will lean in next year. Collaboration does not need to be heavy. A few focused touchpoints make a meaningful difference. Work with channel sales to define lifecycle priorities, shape partner segments, select events, and plan post-event follow-up. Their perspective helps ensure your programs support real partner needs rather than assumptions. Build Budget Buckets That Allow Flexibility When many details remain unsettled, budget buckets help you stay organized without restricting movement. Useful buckets include: Recruitment and awareness Onboarding and activation Enablement and content Partner-led and joint campaigns Events and sponsorships Travel and partner meetings MDF and incentives Systems and automation Flex funds for mid-year opportunities Flex funds play a major role when planning with incomplete information. They allow you to react quickly to new partner interest, regional demand, late-breaking campaigns, and post-event momentum. Treat Events as a Connected Motion Events require early investment, but their real value comes from how you structure what happens around them. Before events , use CRM and portal activity to identify which partners to target and which verticals or regions matter most. During events , shift from sell-through to sell-with by hosting briefings, meetups, or planning sessions. After events , invest in follow-up. This is where flex funds are essential. Support partners (and their customers) with workshops, webinars, new campaigns, and targeted outreach that builds on event conversations. Events without committed follow-through rarely influence the pipeline. A connected approach ensures they do. Support the Middle-Tier Partners The middle tier is an often overlooked growth driver. These partners complete training, download content, or register deals sporadically. They show intent but need structure. Support them with simple co-marketing kits, micro-training paths, low-friction MDF, and targeted follow-up after events. Their steady engagement patterns make them ideal candidates for growth when given consistent support. Plan for Progress, Not Perfect Information You will continue to plan amid shifting budgets, evolving partner priorities, and new product direction. The teams that succeed will be the ones who create structured plans with space for movement and informed pivots. A strong 2026 strategy uses the data you already have, aligns to the partner lifecycle and to-through-with motions, incorporates flexible budget buckets, works closely with channel sales, and supports events with strong follow-through. It nurtures middle-tier partners who often accelerate growth, rewards your top sellers, and depends on systems and feedback loops that help you adjust quickly. Planning with incomplete information is not a limitation. It is the reality of channel marketing today . What matters is creating a plan that is built for motion, supported by insight, and able to grow as the year unfolds.

CMA Flips "Pay to Play" Awards on Its Head With New "Play to Pay" Giving Initiative with Tech4Change

Channel Marketing Association Opens Nominations for 2025 Channel Marketing Excellence Awards